Sluggish Market, Samsung Will Cut Smartphone Shipments Up to 13%

Samsung plans to cut the number of shipments smartphone, as a result of not achieving sales targets. This cut was the result of a decrease in the number of shipments smartphone globally, as well as supply chain issues.

This year has been quite a difficult year for the world’s mobile phone manufacturers, due to declining shipments smartphone globaly. Samsung is also affected.

The South Korean electronics giant is also not “immune” to the recession that has hit the world. As a result of the sluggish global smartphone market, sales smartphone Samsung also missed the target.

Apart from the sluggish market problem due to the economic recession that has hit several countries, supply chain problems caused by the Covid-19 pandemic are one of the main reasons.

READ ALSO:

As a result of these problems, a recent report from Taiwan Economic Daily claims that the Korean company plans to reduce shipments smartphone in the next year.

According to the report, Samsung is said to be planning to reduce the number of shipments smartphone in 2023 up to 13%, or approximately 30 million units.

The reason for this cut is mainly due to the decline in the market smartphonewhich caused the company to be unable to sell smartphone as much as targeted, and market demand continues to weaken.

Samsung was actually able to increase its market share in terms of shipments for the third quarter of this year (Q3 2022) compared to the previous quarter (Q2 2022), but the company experienced an overall decline of around 8% when compared to the previous year (YoY).

Samsung is not the only one affected by the sluggish market. Several smartphone component suppliers, including Japan-based Murata and Taiwan-based Yageo, Tongxin Electic and Duntai, also share the same fate with Samsung.

Murata which supplies modules and electronic components for iPhone, smartphone Samsung, and other mobile phones, have warned that that market smartphone global market is still “not healthy” until next year.

Murata as a leader in passive components MLCC (Multilayer Ceramic Capacitors) has warned that the demand smartphone in Greater China has not shown signs of recovery. That means the downward trend will continue into next year.

Tongxin Electric, a supplier of mobile phone sensor components, said that it may take more than two to three quarters for it to be “detoxified”. Tongxin Electric estimates that in the second quarter of next year or at the end of the third quarter, their business will recover.

Profits are Sagging, but Still Controlling the Market

Samsung has reported earnings in the third quarter of 2022, recording less encouraging results as it experienced a 23% drop in profit. According to the report, the company’s revenue was 76.78 trillion Korean won (USD 54 billion) for the third quarter of 2022, but the decline in profit was already from the previous quarter.

Operating profit was KRW 10.85 trillion or US$ 7.6 billion, down 23 percent from the second quarter of 2022 and around 31.4 percent from the same period last year. Samsung’s operating profit from July to September 2021 was KRW 15.82 trillion, up 26 percent from the previous quarter.

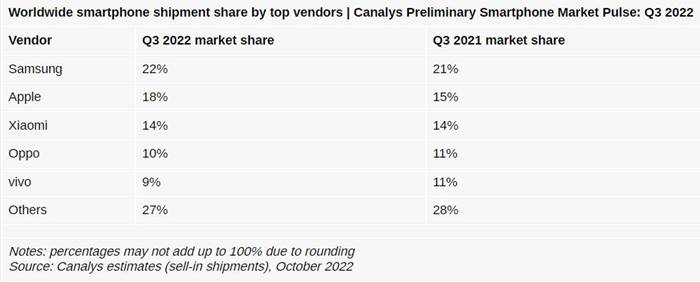

Despite market conditions smartphone Globally for the period July-September 2022 or Q3 is experiencing a negative trend, however, according to research institute Canalys, Samsung is still the market leader.

According to the Canalys research report, Samsung has managed to lead the global smartphone market by successfully breaking 22% or better than Q3 2021 which was only 21%.

Under Samsung, there is Apple which has also experienced an increase in market share. The Cupertino giant was able to achieve a market share of 18% or an increase of 3% compared to last year’s Q3 of 15%.

READ ALSO:

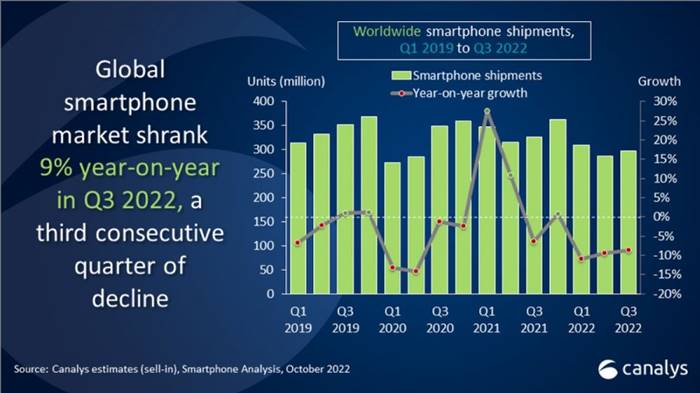

Canalys itself notes the market smartphone Global is not in good condition in Q3 2022. This is because according to research from Canalys, in general, there has been a 9% decline in smartphone shipments compared to last year.

This phenomenon occurs due to a combination of decreased consumer spending and economic uncertainty, resulting in a reduction in the number of shipments by up to 9% or the worst since Q3 2014. [FY/HBS]